Liquidity & Market Dynamics for NFTs on Layer 2: What Creators Need to Know

The next phase of NFT growth won’t come from hype — it will come from liquidity efficiency.

The Great Migration: How Layer 2 is Redefining the NFT Economy's Foundation

For years, Ethereum Mainnet stood as the undisputed, if imperfect, cathedral of the NFT world. It was the hallowed ground where digital ownership was proven, where blue-chip communities were forged, and where the very concept of a non-fungible token was etched into the collective consciousness of the tech and art worlds. However, this prestige came at a cost—a cost measured not just in dollars for gas fees, but in missed opportunities, stifled creativity, and a cap on global participation. By 2025, the NFT economy is undergoing a tectonic shift, moving its center of gravity from a single, congested settlement layer to a vibrant, interconnected archipelago of Layer 2 networks. The central question has evolved from "What is the next must-own project?" to a more fundamental, market-defining inquiry: "On which chain does sustainable, accessible liquidity reside?"

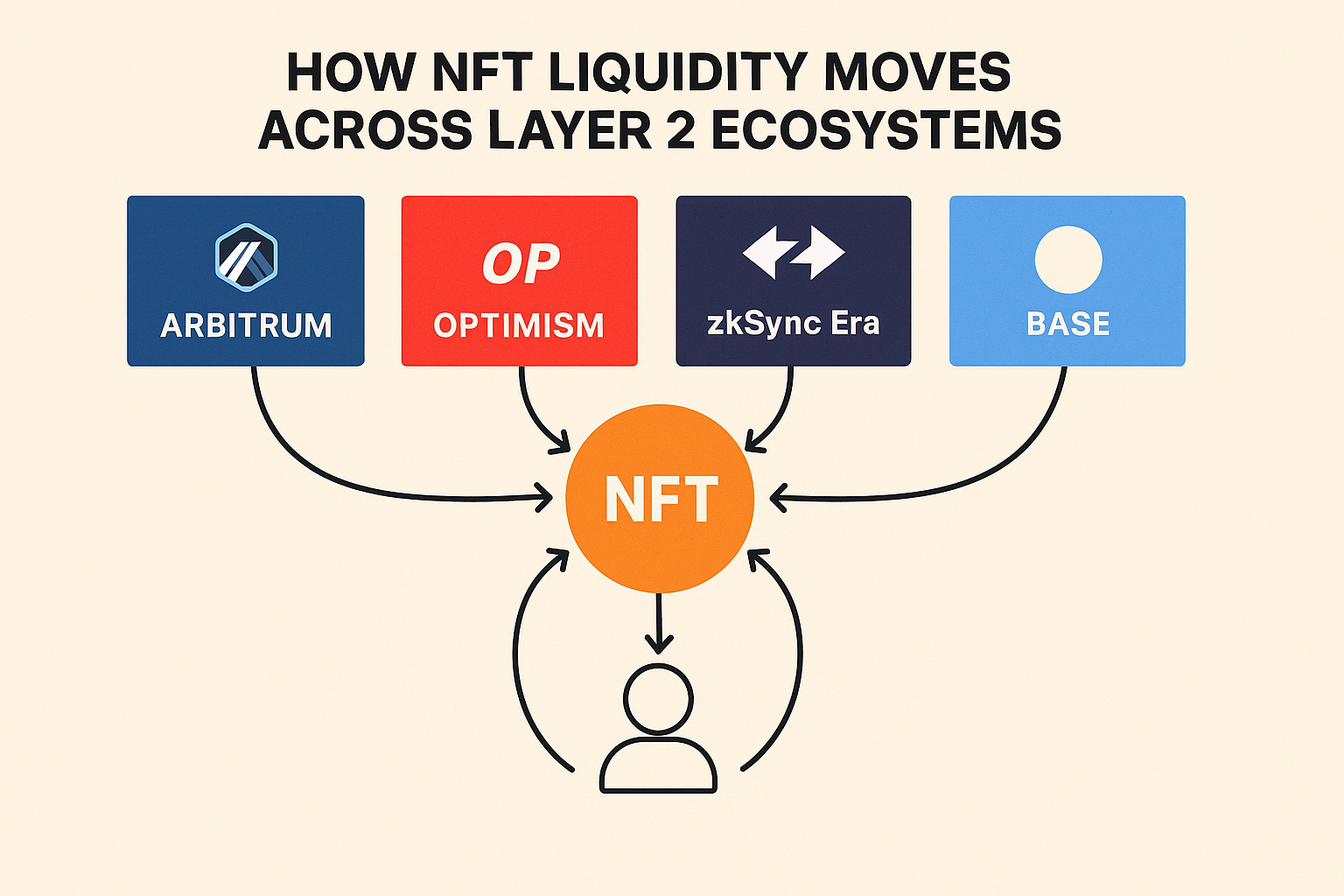

This question of liquidity—the lifeblood of any financial ecosystem, representing the ease with which an asset can be bought or sold without significantly affecting its price—has become the paramount concern for creators, collectors, and investors alike. The migration to Layer 2 networks like Arbitrum, Base, Optimism, and zkSync Era is not merely a technical upgrade; it is a fundamental economic realignment. These networks have systematically dismantled the primary barrier to mass NFT adoption: friction. The exorbitant gas fees, the agonizing wait for transaction confirmations during network congestion, and the psychologically daunting user experience collectively framed NFTs as illiquid luxury items, akin to fine art in a vault. Layer 2 technology is recasting them as fluid, dynamic digital assets, as easy to trade as a stock or a currency pair. In essence, if Layer 1 was the revolutionary canvas that gave birth to the digital art movement, Layer 2 is the global financial infrastructure, trade routes, and market mechanisms that are building a real, functioning economy around it.

This transition is underpinned by a critical understanding of market microstructure. On Layer 1, liquidity was often "phantom" or "shallow"—concentrated in a handful of blue-chip collections and susceptible to dramatic swings based on a few large whale movements. The high cost of transactions acted as a tax on market participation, suppressing trading volume and velocity. Layer 2 chains, with their sub-cent transaction fees and near-instant finality, are flattening this curve. They are democratizing market mechanics, redistributing liquidity across a wider spectrum of projects and empowering smaller, emerging creators with access to the same efficient trading environments that were once the exclusive domain of established, well-capitalized projects. The narrative is shifting from a singular focus on artificial scarcity to a more mature, financially-grounded appreciation for deep, resilient liquidity.

The Mechanics of a Liquid Market: Unpacking the Core Drivers on Layer 2

To comprehend the full impact of this shift, one must move beyond the simplistic metric of a "floor price" and delve into the core drivers that constitute a truly liquid market. In traditional finance, liquidity is the invisible engine that powers everything; it reduces volatility, ensures fair price discovery, and instills investor confidence. For NFTs, liquidity translates directly into the ability for an asset to change hands efficiently, without catastrophic price slippage. The architectural advantages of Layer 2 networks supercharge this engine through several key mechanisms.

First and foremost is the phenomenon of increased trading velocity. Every time a potential collector hesitated to make a bid because of a $30 gas fee, or a holder delayed listing an asset for sale due to the cost, the entire market became less efficient. This friction created a stagnant pool of assets and suppressed the natural price discovery process. On Layer 2, with gas fees rendered virtually negligible, these psychological and economic barriers vanish. Collectors can rebalance their portfolios with the ease of swiping on a social media feed, and market makers can provide continuous liquidity without being eroded by fees. This heightened velocity leads to more robust and accurate price discovery. A higher frequency of trades means the market can more rapidly and reliably converge on a "true" fair value for an asset, resulting in floor prices that are more resilient and bid-ask spreads that are significantly tighter, mirroring the order book depth seen in mature equity markets.

Secondly, Layer 2 enables entirely new financial primitives that were economically unviable on Layer 1, most notably fractionalization and micro-liquidity. The high cost of minting and transacting made the fractional ownership of a single NFT a prohibitively complex and expensive endeavor. Now, platforms can seamlessly tokenize a high-value digital artwork or a historical collectible into thousands of tradable fractions, creating vibrant secondary markets around assets that were previously locked in a state of illiquidity. This gives rise to sophisticated NFT liquidity pools and automated market makers (AMMs), where users can gain exposure to NFT price movements in a fungible, ERC-20-like format. This "defragmentation" of NFT value unlocks immense latent capital, allowing for smaller investors to participate in the upside of blue-chip assets and providing existing holders with a mechanism to extract liquidity without selling their entire position.

Finally, the dynamics of cross-chain liquidity and collector migration are creating a more interconnected and efficient global marketplace. Liquidity is not static; it is a fluid entity that flows towards the ecosystems offering the best combination of user experience, financial incentives, and cultural vibrancy. We are witnessing this in real-time: Base is leveraging its seamless integration with Coinbase to onboard a wave of mainstream, retail users; Arbitrum and Optimism have become fertile ground for complex NFT-gaming economies that require thousands of micro-transactions; and zkSync is attracting a tech-savvy creator community with its advanced ZK-proof technology enabling instant settlement. Underpinning this migration is a new stack of cross-chain infrastructure—aggregators like Tensor and Reservoir, and bridges like Layerswap—that are making it effortless for liquidity to follow demand, ensuring that creators who build on these networks can tap into a global, rather than a siloed, pool of capital.

The Creator's Playbook: Navigating and Thriving in the Multi-Chain Liquidity Era

For creators, this new paradigm is not just a technical backdrop; it is the very playing field on which they must now compete and build. Understanding and strategically engaging with Layer 2 liquidity is no longer a secondary consideration—it is a primary determinant of long-term success. The first and most critical decision is the strategic selection of an ecosystem. The choice is no longer monolithic; each major Layer 2 network has cultivated a distinct identity and liquidity profile. Base, with its direct fiat on-ramps and massive retail user base from Coinbase, is ideal for projects aiming for mass-market accessibility and brand-building. Arbitrum Nova, optimized for high-throughput applications, is the superior environment for gaming projects and social experiences where in-game asset liquidity is paramount. Zora Network has positioned itself as the cultural hub for artists and creators who prioritize community-driven drops and open editions, fostering a different kind of liquidity rooted in cultural momentum rather than pure speculation. zkSync Era, with its cutting-edge zero-knowledge technology, offers a high-performance environment for applications requiring the fastest possible finality and advanced trading features.

Once a foundation is chosen, creators must shift their mindset from simply incentivizing the initial mint to actively cultivating and rewarding ongoing liquidity. The low-fee environment of Layer 2 makes sophisticated micro-economies feasible. Instead of one-time airdrops, creators can implement continuous liquidity mining programs, distributing rewards to users who provide liquidity in pools or who maintain consistent bid and ask orders on marketplaces. Royalty structures can be designed to be more dynamic, perhaps offering discounts or exclusive access to the most loyal and active traders in a collection's ecosystem. The goal is to build a flywheel where liquidity begets more liquidity, creating a self-sustaining economic environment for the project.

Furthermore, creators must adopt a cross-chain future-proofing strategy from the outset. Even if a project launches exclusively on one Layer 2, the smart contracts and metadata should be architected with cross-chain portability in mind. Utilizing standards that are compatible with major bridging protocols ensures that a project is not permanently siloed and can easily migrate or expand to new ecosystems as liquidity patterns evolve. This also involves embracing a new suite of analytical tools. Transparency is the currency of trust in a decentralized market, and creators who leverage dashboards from Dune, Nansen, and Zapper to provide clear, verifiable data on their project's liquidity health—trading volume, holder distribution, cross-chain activity—will build stronger, more confident communities. In the multi-chain world, liquidity isn't just a metric; it's the narrative, and the creators who can tell that story most effectively will be the ones to capture the next wave of value and adoption in Web3.

Topics

Recent comments