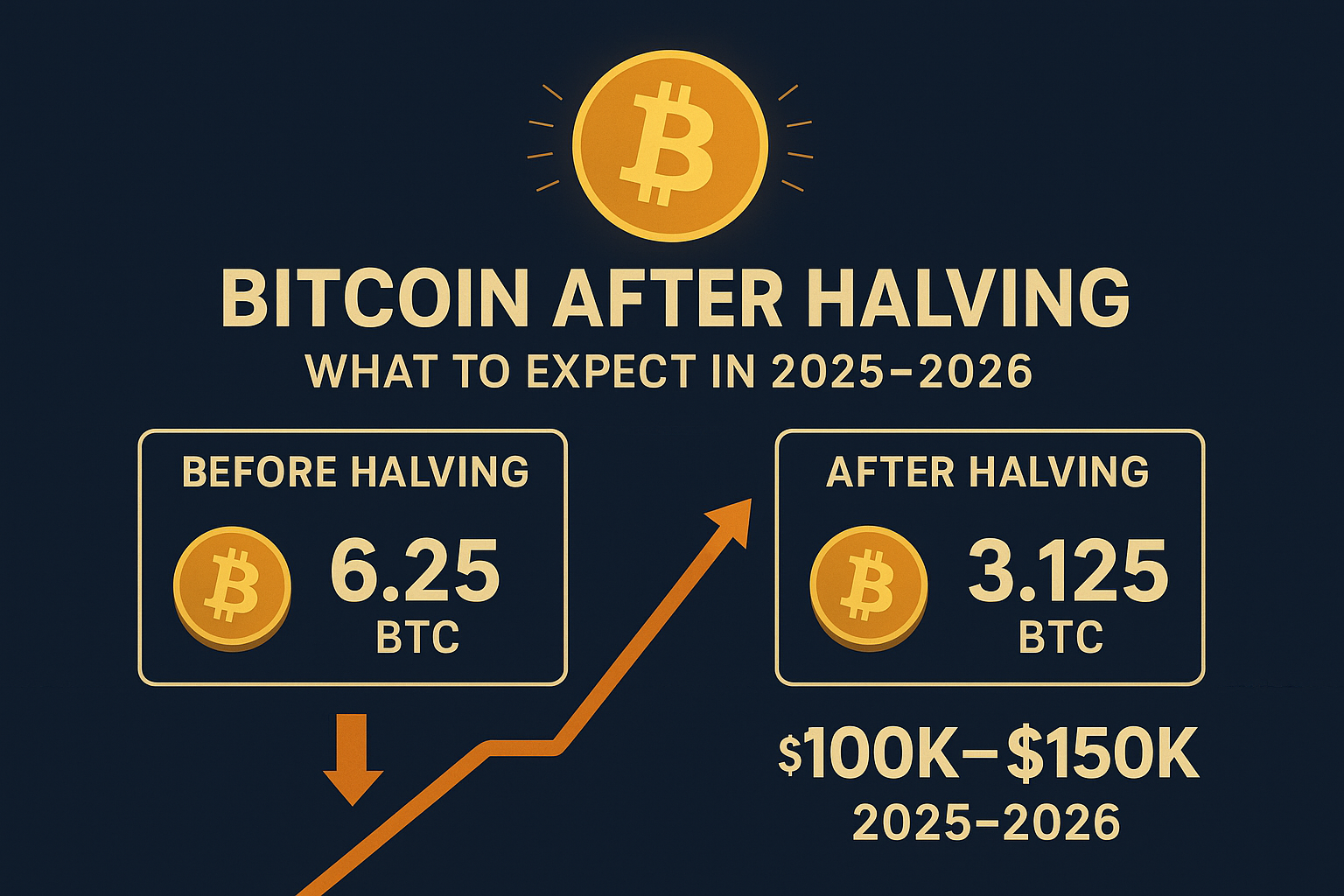

₿ Bitcoin After the Halving: What to Expect in 2025–2026

Every four years, Bitcoin undergoes a halving event — when the reward for mining new blocks is cut in half. The most recent halving took place in April 2024, reducing block rewards from 6.25 BTC to 3.125 BTC.

Historically, halvings have been catalysts for Bitcoin’s price growth and broader crypto market rallies. But what’s next? Let’s explore what 2025–2026 could look like for Bitcoin.

📉 1. Reduced Supply = Increased Scarcity

Bitcoin’s fixed supply of 21 million coins is its most powerful feature. With fewer new BTC entering circulation, the market becomes more supply-constrained.

History shows: After the 2012, 2016, and 2020 halvings, Bitcoin entered major bull runs.

In 2025–2026, scarcity could again play a central role in driving prices upward.

📈 2. Potential Price Growth — But With Volatility

Most analysts expect Bitcoin to hit new all-time highs in the cycle following the 2024 halving.

Optimistic predictions suggest BTC could test the $100k–$150k range.

Others remain cautious, pointing to macroeconomic uncertainty, regulations, and competition from altcoins.

One thing is certain: volatility will remain part of Bitcoin’s DNA.

🏦 3. Rising Institutional Adoption

Institutions continue to shape Bitcoin’s narrative:

Bitcoin ETFs have made investing more accessible to traditional markets.

Corporations adding BTC to their balance sheets strengthen its position as “digital gold.”

Growing interest from pension funds and sovereign wealth funds could push demand even higher in 2025–2026.

🔐 4. Mining Industry Shifts

With block rewards cut in half, miners face tighter profit margins. This often leads to:

Consolidation among mining companies.

Increased reliance on renewable energy to cut costs.

Geographic shifts toward regions with cheap electricity.

Long term, this strengthens Bitcoin’s resilience but may push out smaller players.

🌍 5. Broader Market Impact

Bitcoin’s post-halving cycles have historically lifted the entire crypto market. In 2025–2026, we could see:

Renewed growth in altcoins and DeFi projects.

Expanded adoption of Layer 2 scaling solutions like the Lightning Network.

Stronger narratives around Bitcoin as a hedge against inflation.

⚠️ Key Risks to Watch

Despite optimism, there are challenges ahead:

Regulation: Governments may tighten oversight on crypto markets.

Macro environment: Interest rates, inflation, and global economic trends can impact demand.

Competition: Ethereum, Solana, and other ecosystems may capture investor attention.

🎯 Conclusion

The 2024 halving has set the stage for an exciting 2025–2026. While history doesn’t repeat exactly, it often rhymes — and scarcity, institutional adoption, and global trends suggest Bitcoin could see strong upward momentum.

For investors, the key is balance: expect growth, prepare for volatility, and stay informed.

👉 Track Bitcoin’s movements and the latest crypto events with the NFTBirdies Calendar to never miss what’s next.

Topics

Recent comments